Metaplanet borrows yen at 0% interest, buys Bitcoin, and benefits as the yen weakens. With Japan’s debt-to-GDP at 237% and the BOJ keeping rates near zero, this arbitrage makes their BTC purchases essentially free.

From Struggling Hotel to Bitcoin Treasury Giant

Metaplanet wasn’t always a Bitcoin company. In 2020, COVID-19 crushed Japan’s hospitality sector, forcing the company to suspend operations in three of its four markets. By late 2023, Japanese regulators issued a going concern warning—the company was on the verge of failure.

Then came the pivot.

In April 2024, under CEO Simon Gerovich (a former Goldman Sachs derivatives trader), Metaplanet adopted Bitcoin as its primary treasury reserve asset. Michael Saylor took notice, calling Metaplanet “Japan’s MicroStrategy.”

The Results Speak for Themselves

| Metric | Result |

|---|---|

| Stock Performance | +5,753% (¥28 → ¥1,644) in 2024 |

| vs Tesla | Tesla: -19% |

| vs Nvidia | Nvidia: +104% |

| vs Apple | Apple: +12% |

| vs Amazon | Amazon: +8% |

| Global Ranking | Best performing stock in 2024 |

| Index Inclusion | MSCI Japan Index (Feb 2025) |

In June 2025, Gerovich announced Asia’s largest-ever equity raise dedicated to Bitcoin: ¥770.9 billion (~$5.4B) via moving strike warrants—a first for Japan.

Why Japan? The Perfect Storm for a Bitcoin Carry Trade

To understand Metaplanet’s strategy, you need to understand Japan’s unique economic situation.

Japan’s Debt Burden: The Highest in the World

Japan has the highest government debt-to-GDP ratio of any major economy at 236.7% in 2024. Only Sudan (272%) is higher globally.

| Metric | Value | Source |

|---|---|---|

| Debt-to-GDP | 236.7% | Trading Economics |

| Domestic holders | 88.1% | |

| BOJ holdings | 46.3% of all govt bonds | |

| Debt servicing | 22% of national budget | Wikipedia |

This massive debt burden forces the Bank of Japan to keep interest rates low—they literally cannot afford higher rates.

The Weak Yen: A Feature, Not a Bug

Between January 2021 and June 2024, the yen depreciated over 50% against the US dollar. In July 2024, it hit 161.5 yen per dollar—the lowest since 1990.

Why the Yen Keeps Falling:

- Interest rate differential: US Fed at 5.25-5.50% vs BOJ at 0-0.1%

- Monetary policy divergence: BOJ never joined the post-COVID rate hike cycle

- Massive debt: Forces BOJ to cap government bond yields

- Trade deficit: Energy imports require constant yen-to-dollar conversion

On a superficial level, recent yen depreciation is the product of monetary policy divergence. But on a deeper level, the falling yen is really about Japan’s large debt burden, which forces the Bank of Japan to cap long-term government bond yields.

BOJ’s Historic Policy Shift (But Still Ultra-Low)

In March 2024, the BOJ ended 17 years of negative interest rates, raising from -0.1% to 0-0.1%. By December 2025, rates reached 0.75%—still the lowest among major economies.

Source: CNBC, World Economic Forum

The Yen Carry Trade: How It Actually Works

The Strategy:

- Borrow cheap yen at 0% interest

- Buy Bitcoin

- Repay debt in a weakening currency

- Profit from BTC appreciation AND currency devaluation

The result is a carry trade dynamic that works in Metaplanet’s favor—the company borrows in cheap yen, acquires Bitcoin that appreciates against fiat, and repays coupons in a currency that keeps losing value.

Zero-Interest Bond Issuances

Metaplanet has issued multiple rounds of 0% interest bonds, all subscribed by EVO Fund (a Cayman Islands-based institutional investor).

| Date | Amount | Interest | Source |

|---|---|---|---|

| Feb 2025 | ¥2B ($13.35M) | 0% | Bitcoin Ethereum News |

| May 2025 | ¥3.6B ($24.8M) | 0% | CoinDesk |

| June 2025 | ¥30B ($240M) | 0% | CryptoCoverage |

| June 2025 | $210M | 0% | Cryptonews |

When asked about the $210M bond issuance, CEO Simon Gerovich had a simple response:

“$210M. 0% interest. All Bitcoin.”

Simon Gerovich, CEO, on X

Who is EVO Fund?

EVO Fund is the primary backer behind Metaplanet’s Bitcoin strategy:

- Cayman Islands-based investment fund managed by Evolution Capital Management

- Founded by Michael L. Larch (Princeton graduate, former Goldman Sachs)

- 500+ staff across 10 global offices, with 250+ operating in Japan

- Held up to 28.17% of Metaplanet shares as largest shareholder in early 2025

- Uses Moving Strike Warrants—exercise price adjusts upward as stock rises

As Metaplanet’s stock rose from ¥20 to ¥1,600 (an 80x increase), EVO Fund reduced its stake to 4.45%, taking profits at higher prices.

Source: Crypto Times Japan

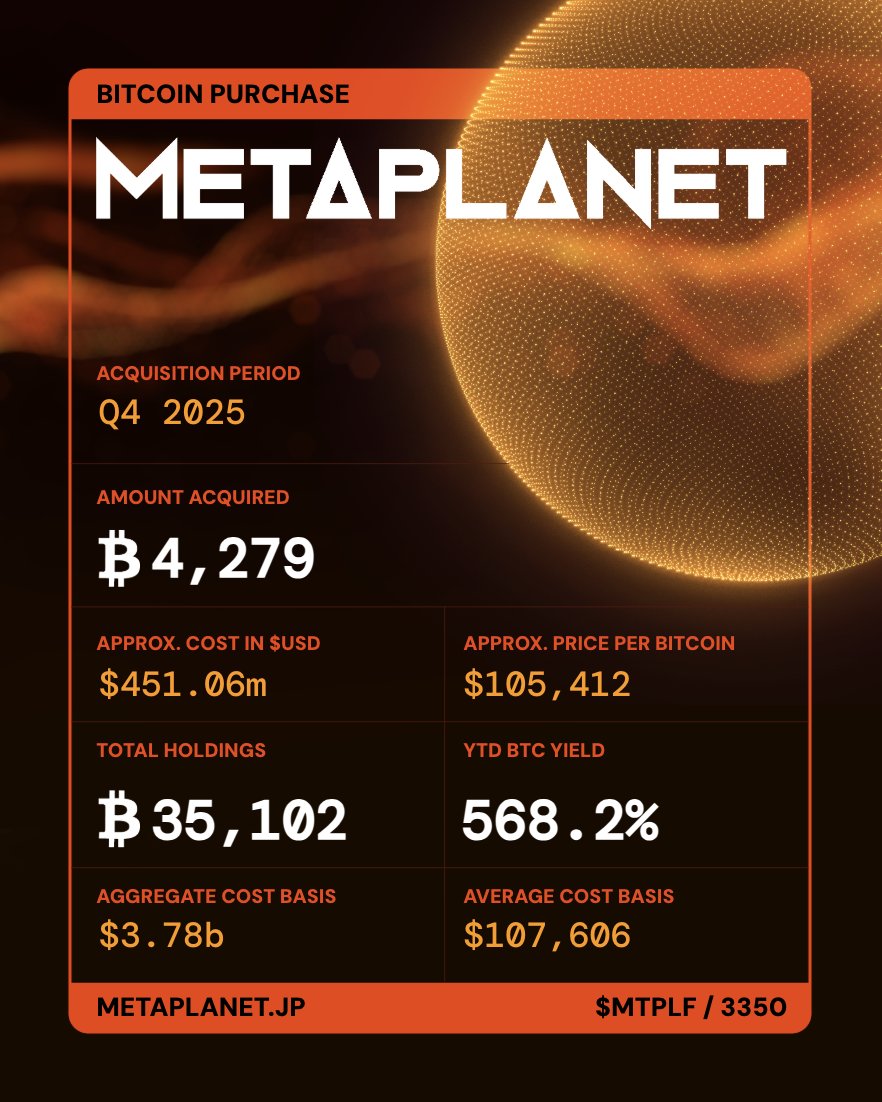

The Bitcoin Stack: From 98 to 35,000+ BTC

Metaplanet’s Bitcoin accumulation has been relentless:

| Date | BTC Holdings | Notes |

|---|---|---|

| April 2024 | 98 BTC | Initial purchase (~¥1B) |

| December 2024 | 1,762 BTC | Cost basis: ¥20.9B |

| March 2025 | 3,350 BTC | |

| May 2025 | 7,800 BTC | |

| September 2025 | 20,136 BTC | 6th largest globally |

| December 2025 | 35,102 BTC | $3.78 billion |

Source: Bitcoin Treasuries

The Targets

| Year | Target | Status |

|---|---|---|

| 2025 | 10,000 BTC | ✅ Exceeded |

| 2026 | 100,000 BTC | In progress |

| 2027 | 210,000 BTC | 1% of total Bitcoin supply |

Metaplanet vs MicroStrategy: Key Differences

Both companies use Bitcoin as a treasury asset, but their approaches differ significantly.

Adam Back (Blockstream CEO) analyzed both companies:

Financing Methods

| Aspect | MicroStrategy (Strategy) | Metaplanet |

|---|---|---|

| Approach | Aggressive convertible bonds, preferred stock | 0% interest bonds + options strategies |

| Speed | Moves fast and big | Structured, deliberate |

| Interest Rates | Variable (market rates) | 0% (Japan advantage) |

Source: Cointelegraph

Growth Comparison

According to Blockstream CEO Adam Back, Metaplanet is growing 3.8x faster than MicroStrategy in terms of mNAV (market Net Asset Value) coverage:

| Metric | MicroStrategy | Metaplanet |

|---|---|---|

| Time to 2x BTC yield | 19 months | 3 months |

| Current mNAV | 2.16x | 3.3x |

Source: Bitget News

Revenue Model

Unlike MicroStrategy, Metaplanet generates income from Bitcoin holdings without selling:

- Lending BTC to institutional borrowers for interest

- Selling covered call options on holdings

- Generated ~$55M in revenue through options in FY2025

Source: Yahoo Finance

Beyond Treasury: The Bitcoin Hotel

Metaplanet isn’t just stacking Bitcoin—they’re building infrastructure:

The Bitcoin Hotel features a world-first Bitcoin gallery, art museum, and community spaces—turning Metaplanet’s hospitality roots into a Bitcoin education hub.

Risks and Criticisms

Warning: Every investment thesis has risks. Here are the legitimate concerns with Metaplanet’s strategy.

Bitcoin Price Risk

The company’s average acquisition cost is approximately $108,000 per BTC. When Bitcoin traded around $89,000, this created substantial unrealized losses.

- If Bitcoin drops below $70,000: Potential forced asset sales to maintain collateral

- Stock has dropped 81% from mid-2025 highs during bearish conditions

Source: OKX Learn

BOJ Policy Risk

The BOJ raised rates to 0.75% in December 2025. Further tightening could:

- Strengthen the yen, reducing the carry trade advantage

- Trigger carry-trade unwinds, reducing liquidity for Bitcoin

- Make future bond issuances more expensive

Source: AInvest

Concentration Risk

- Single institutional backer (EVO Fund) for most bond issuances

- Heavy reliance on Bitcoin price appreciation

- EVO Fund has reduced stake from 28% to 4.45% as stock rose

The Bottom Line

Metaplanet’s strategy is a masterclass in financial engineering: leverage Japan’s unique macroeconomic conditions (high debt, weak currency, low rates) to acquire a hard asset that appreciates in those exact conditions.

The thesis in one sentence: Borrow in a currency that’s losing value, buy an asset that’s gaining value, repay debt with cheaper money.

Whether this ends as a genius trade or a cautionary tale depends entirely on Bitcoin’s long-term trajectory. But as of now, Metaplanet has transformed from a dying hotel company to Asia’s largest public Bitcoin holder.

Key Sources

Company & Holdings

Bond Issuances

- CoinDesk - Metaplanet Issues $25M Bonds

- Cryptonews - $210M Bond Issuance

- Decrypt - $25.9M Bond Raise

Japan Economic Data

- Trading Economics - Japan Debt to GDP

- Trading Economics - Japan Interest Rate

- CNBC - BOJ Ends Negative Rates

- Al Jazeera - Why Yen is Weak

- Brookings - Japan’s Falling Yen

Strategy Comparison

- Cointelegraph - Metaplanet vs Strategy

- Adam Back Analysis

- BitMEX - Is 7× mNAV Justified?

- Michael Saylor on Metaplanet